President of the International Centre for Tax Research and Development, Mrs. Morenike Babington-Ashaye, has called for greater accountability and transparency in the management of Nigeria’s tax revenues. She emphasized that public officials responsible for managing the nation’s commonwealth must ensure that tax proceeds are accounted for and used in accordance with the law.

Speaking at a lecture titled “The Political Economy of the Nigerian Tax Reform and its Social Implications” during the 20th anniversary celebration of the Tax Club, University of Lagos, Babington-Ashaye urged the National and State Assemblies to distinguish tax revenues from other sources of income and to clearly communicate their utilization—particularly in areas such as infrastructure development, social services, and direct benefits to citizens.

She recommended that State Houses of Assembly enact legislation to define how public revenues are distributed between government and citizens, noting that poverty should not be a persistent issue in a resource-rich country like Nigeria.

A past president of the Chartered Institute of Taxation of Nigeria (CITN), Babington-Ashaye further stressed the need for a more balanced allocation of tax revenues, one that prioritizes critical infrastructure and social services over mere administrative budgets for Ministries, Departments, and Agencies (MDAs).

Highlighting the impact of current budgetary priorities, she cited the rise in school fees and the growing number of out-of-school children. She advocated for education funding models—such as vouchers or grants—that empower schools to function effectively without placing the financial burden on families. According to her, governments are obligated to provide citizens with clear, accessible information on how their tax contributions are being used.

She also critiqued the centralised approach to tax administration and revenue sharing, describing it as regressive in a diverse nation like Nigeria. Concentrating fiscal power at the federal level, she warned, could lead to deeper economic instability.

On the broader economic implications of tax reform, Babington-Ashaye supported the elimination of multiple taxes to encourage growth and improve efficiency in tax administration. However, she identified several structural challenges—including exchange rate volatility, widespread insecurity, corruption, economic disparity, deteriorating education standards, and a lack of skilled workforce—as significant impediments to economic progress.

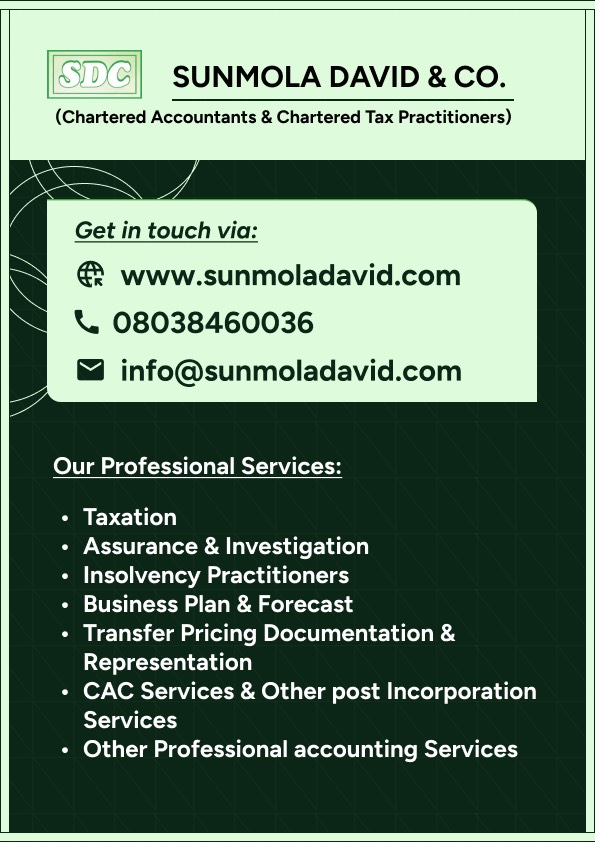

For professional advice on Accountancy, Transfer Pricing, Tax, Assurance, Outsourcing, online accounting support, Company Registration, and CAC matters, please contact Inner Konsult Ltd at www.innerkonsult.com at Lagos, Ogun state Nigeria offices. You can also reach us via WhatsApp at +2348038460036.