Real estate stakeholders have expressed optimism that once the Tax Reform Bill is enacted, real estate transactions will be exempt from Value Added Tax (VAT). This assurance was further reinforced by Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, who stated that the bill is designed to benefit low-income earners and help bridge the country’s housing deficit.

According to Oyedele, the VAT exemption is expected to reduce the cost of building materials and overall housing expenses. He emphasized that the bill, contrary to some misconceptions, is structured to ease the financial burden on low-income households.

He noted, “There will be no VAT on land transactions, real estate sales, and rent, which have previously been contentious issues.”

Oyedele made these remarks during a Building and Construction Industry Forum co-hosted by the Council of Registered Builders of Nigeria (CORBON) and the Housing Development Advocacy Network (HDAN). Themed “Nigeria’s Tax Reforms and the Building and Construction Industry: Implications and Opportunities,” the event served as a platform to clarify the bill’s broader benefits. Oyedele expressed concern that the reform is being misinterpreted by some individuals.

He also highlighted other provisions in the bill, including stamp duty exemptions for rents below ₦10 million per month and capital gains tax waivers on the sale of residential homes. Additionally, he said that producers of building materials, especially non-metallic products, will be eligible for priority sector incentives to boost local production. He assured stakeholders that land transactions, titling processes, and property tax harmonization will be improved under the reforms.

“The Tax Reform Bill aims to make housing more affordable and ease the tax burden for renters,” Oyedele explained. “Ultimately, the reforms are designed to improve the quality of life, stimulate the construction sector, and enhance overall economic activity.” He urged Nigerians to seek accurate information about the reforms rather than relying on misleading headlines or social media narratives.

Speaking at the event, the Minister of Housing and Urban Development, Ahmed Dangiwa—represented by Temitope Gbemi, Director of Public Buildings—affirmed that the bill offers significant relief to construction companies and contractors. He added that the ministry is aligning its housing policies with fiscal reforms, collaborating with tax authorities to ensure that real estate investments are governed by transparency, fairness, and investor protection.

CORBON Chairman, Samson Opaluwah, pointed to limited access to finance and multiple taxation as key challenges impeding the council’s growth. He expressed hope that the bill would address these issues effectively.

Meanwhile, HDAN Executive Director, Festus Adebayo, welcomed the VAT exemptions on land, real estate, and building materials. He called for additional incentives in the bill to attract developers and investors to build affordable housing for low-income earners.

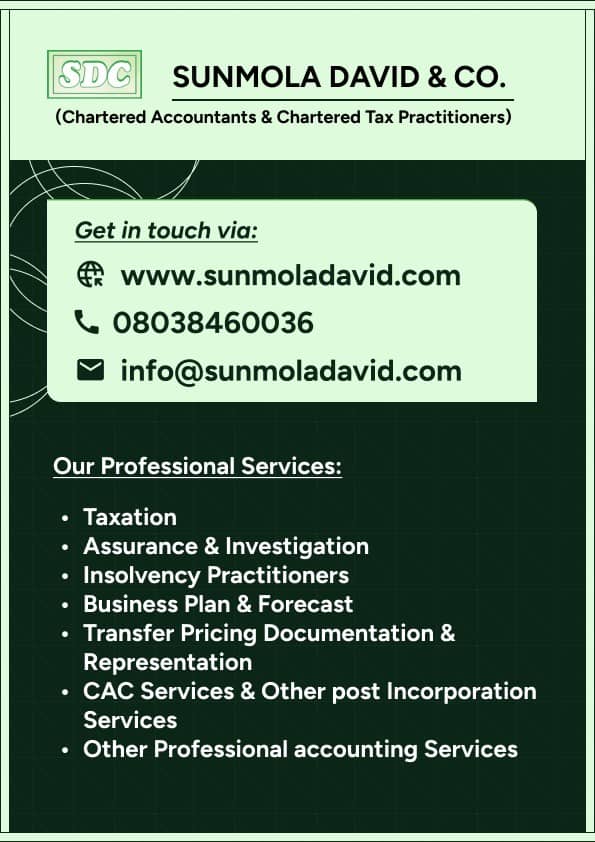

For professional advice on Accountancy, Transfer Pricing, Tax, Assurance, Outsourcing, online accounting support, Company Registration, and CAC matters, please contact Sunmola David & CO (Chartered Accountants & Tax Practitioners) at Lagos, Ogun state Nigeria offices, www.sunmoladavid.com. You can also reach us via WhatsApp at +2348038460036.