President Bola Tinubu has reaffirmed that the federal government’s ongoing tax reforms aim to boost revenue generation and eliminate inefficiencies within Nigeria’s tax system.

Represented by the Minister of State for Finance, Doris Uzoka-Anite, at the 27th Annual Tax Conference in Abuja, Tinubu stated that these reforms are central to the administration’s broader economic agenda.

He noted that the conference theme, “Taxation for Development, Policies, Law, and Implementation,” aligns with the government’s current efforts to build a more robust and transparent tax framework. A fair and efficient tax system, he emphasized, is vital not only for funding public services but also for ensuring economic stability and long-term development.

President Tinubu highlighted the creation of the Presidential Committee on Fiscal Policy and Tax Reforms, which is tasked with simplifying the tax structure, minimizing revenue leakages, and improving coordination across all levels of government. He also referenced the recent passage of the Economy Stabilisation Bill and four tax-related legislations aimed at reinforcing Nigeria’s domestic revenue base.

He stressed the administration’s growing reliance on technology and data analytics to enhance tax compliance and operational efficiency, noting that digital solutions are already yielding results through increased transparency in tax collection.

Vice President Kashim Shettima, represented by Dr. Tope Fasua, echoed the importance of tax reform in advancing national development. He commended the Chartered Institute of Taxation of Nigeria (CITN) for its vital contributions and emphasized the need for collaboration between citizens and tax administrators to ensure the reforms’ success.

Shettima also outlined other key reforms that have drawn global attention, such as adjustments to the foreign exchange system, removal of fuel subsidies, and a 130% increase in the minimum wage. While acknowledging the disruptive impact of these changes, he maintained they are starting to produce tangible benefits.

He praised state governments for their efforts in cutting debt and increasing internally generated revenue. Additionally, he lauded the President’s “Buy Nigeria” initiative, which he said is bolstering local businesses and creating jobs, particularly in rural communities.

Highlighting the pro-poor orientation of current tax policies, Shettima stressed that the reforms aim to ensure fairness and reduce poverty. He called for continued collaboration and pragmatic approaches to strengthen tax institutions, uphold fiscal discipline, and foster sustainable economic growth.

In his opening remarks, CITN President Samuel Agbeluyi emphasized that taxation is not just a means of raising revenue—it plays a critical role in promoting equity and supporting essential public services. He urged for stronger alignment between policy, legislation, and implementation, and called on the government to build public trust to enhance compliance and shared prosperity.

Agbeluyi also acknowledged the Tinubu administration’s reform efforts, affirming that tax professionals have a pivotal role to play in driving the agenda forward.

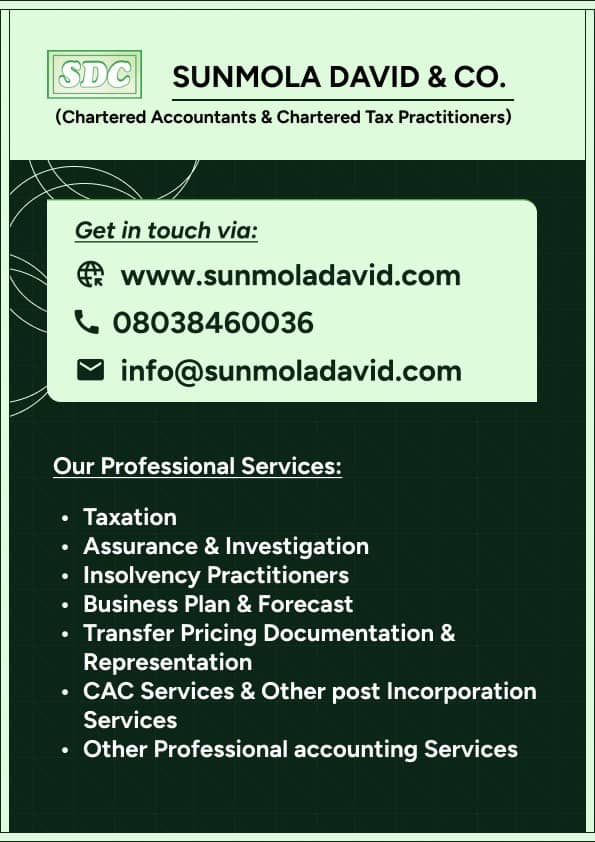

For professional advice on Accountancy, Transfer Pricing, Tax, Assurance, Outsourcing, online accounting support, Company Registration, and CAC matters, please contact Sunmola David & CO (Chartered Accountants & Tax Practitioners) at Lagos, Ogun state Nigeria offices, www.sunmoladavid.com. You can also reach us via WhatsApp at +2348038460036.