Domestic airline operators in Nigeria, under the Airline Operators of Nigeria (AON), have issued a strong warning regarding the Tax Reform Act signed into law by President Bola Tinubu on June 26, 2025. According to AON, if implemented as scheduled on January 1, 2026, the reforms could “cripple airline operations within 48 hours.”

The sweeping legislative package includes:

- Nigeria Tax Act (NTA)

- Nigeria Tax Administration Act (NTAA)

- Nigeria Revenue Service Act (NRSA)

- Joint Revenue Board Act (JRBA)

The potential impact of these reforms was a major point of discussion at the 29th Annual Conference of the League of Airport and Aviation Correspondents (LAAC), themed “Financing Aviation in Nigeria: Risks, Opportunities, and Prospects.”

Concerns from Industry Leaders

Allen Onyema, Vice Chairman of AON and Chairman of Air Peace, Nigeria’s largest airline, described the new tax measures as unsustainable for an already fragile industry.

“Airlines in this country are taxed to death,” Onyema stated. “If implemented, these reforms will reintroduce customs duties on imported aircraft, spare parts, and tax airfares—all of which directly threaten the financial viability of carriers.”

He argued that aviation operates on razor-thin profit margins—typically 3% to 5%, compared to much higher returns in sectors like agriculture or general importation. Imposing multiple levies, especially without corresponding value or infrastructure improvements, would render domestic airlines unprofitable.

Onyema also criticized the 5% Ticket Sales Charge (TSC) collected by the Nigerian Civil Aviation Authority (NCAA), noting that most airlines don’t even realize 5% net margins, making the charge disproportionately burdensome.

“We are not saying government shouldn’t earn revenue, but charges should be cost-recovery based, in line with ICAO standards,” he added.

Macroeconomic Context and Policy Signals

Bismarck Rewane, CEO of Financial Derivatives Company, added a macroeconomic perspective, citing the aviation sector’s 0.81% contraction in Q1 2025—its sixth consecutive quarterly decline. Rewane emphasized the need for policy consistency to rebuild investor trust and attract global aviation capital.

“Without coherent and stable policies, investor confidence erodes. Regulatory clarity is essential for the survival and expansion of the sector,” Rewane noted.

A Call for Immediate Government Intervention

While the Federal Government aims to boost revenue through reforms, AON insists that a one-size-fits-all approach could jeopardize aviation’s strategic role in national development. The Minister of Aviation and Aerospace Development, Festus Keyamo, is reportedly engaging with stakeholders to address the concerns raised.

Tax Consulting Insight:

With the 2026 implementation of the Tax Reform Act approaching, industry stakeholders—particularly those in capital-intensive sectors like aviation—should urgently:

- Conduct impact assessments on direct and indirect tax exposure under the new laws.

- Engage regulatory bodies early to advocate for sector-specific exemptions or phased implementation.

- Review customs, VAT, and withholding tax policies around aircraft acquisition and maintenance.

- Prepare for increased compliance requirements under the revamped tax administration regime.

This case highlights the critical importance of tax policy design aligned with industry realities. As advisors, our role is to help clients navigate reform uncertainty with strategic planning, risk mitigation, and engagement with tax authorities.

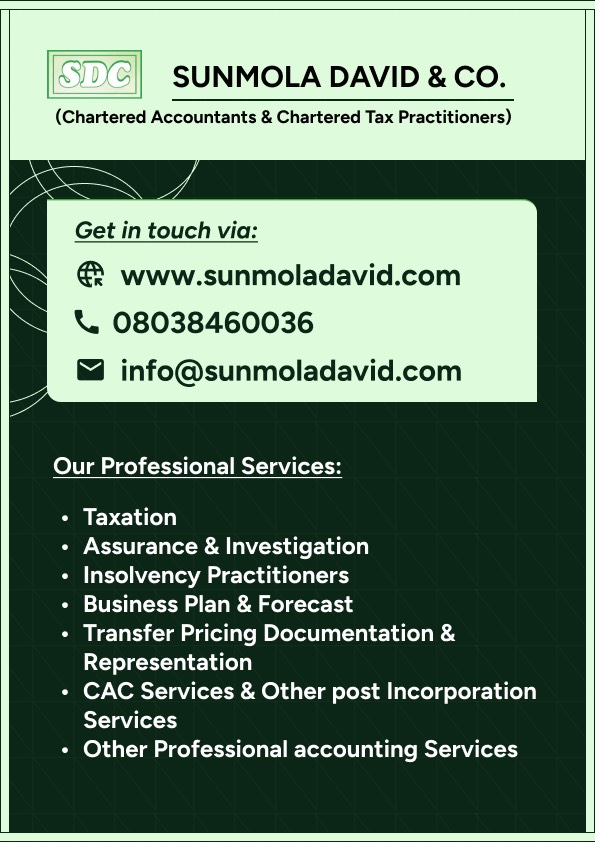

For professional advice on Accountancy, Transfer Pricing, Tax, Assurance, Outsourcing, online accounting support, Company Registration, and CAC matters, please contact Inner Konsult Ltd at www.innerkonsult.com at Lagos, Ogun state Nigeria offices. You can also reach us via WhatsApp at +2348038460036.