“I also extend my heartfelt appreciation to my colleagues on the House Conference Committee, which I had the honour of leading, for their steadfast commitment to the Nigerian people. Your dedication and resilience in concluding this important task are truly commendable, and we remain deeply grateful.”

It was reported that the four tax bills were submitted two weeks ago to the Joint Harmonisation Committee, comprising members of both the Senate and the House of Representatives, to reconcile differences in amendments before being forwarded to President Bola Tinubu for assent.

Following a majority voice vote, the Senate President, Godswill Akpabio, announced the passage of the bills and lauded the lawmakers for their sacrifice in reforming Nigeria’s tax system to align with international standards.

“These four executive bills aim to transform and modernise the tax framework in Nigeria,” he stated.

The development comes just 24 hours after the Senate passed two of the bills, deferring the remaining ones for consideration on Thursday.

Speaking to journalists after plenary, Senator Sani Musa, Chairman of the ad hoc committee on tax reform and representative of Niger East Senatorial District, affirmed that the committee worked diligently to ensure the proposed tax system meets global benchmarks.

He further revealed that part of the revenue generated from the tax reforms will be allocated toward combating cybercrime, enhancing defence infrastructure, supporting TETFund, and providing assistance to military personnel engaged in peacekeeping efforts across the country.

Senator Musa also emphasized the committee’s recommendation for the President to appoint a chairman and establish an ombudsman to arbitrate and resolve tax-related disputes.

He stressed the critical importance of setting up a tax tribunal, noting:

“It is not a court of record. We have carefully reviewed issues surrounding VAT, tax collection, development levies, and the previously expunged inheritance tax.”

Expressing optimism, he added, “I believe Nigerians will witness tangible improvements as a result of these reforms. We also commend the President for ensuring a level playing field for all stakeholder

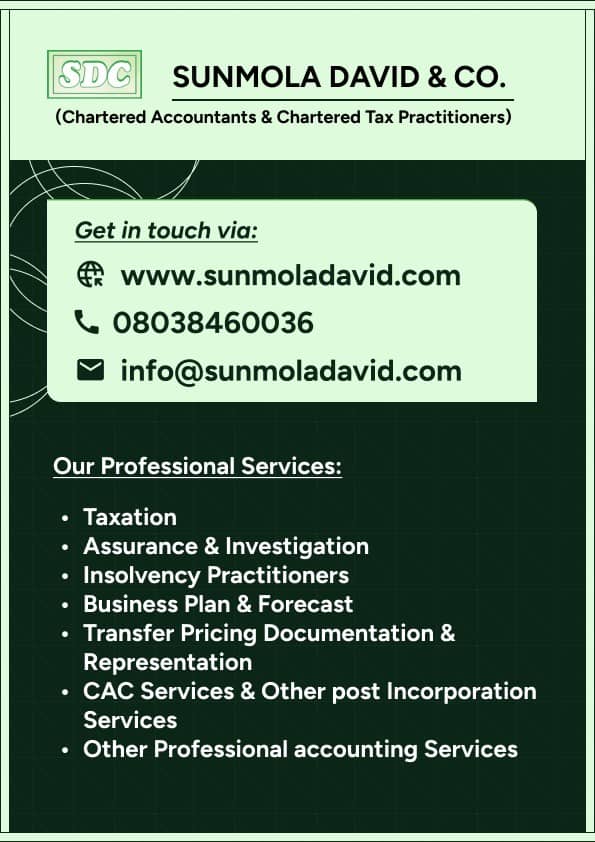

For professional advice on Accountancy, Transfer Pricing, Tax, Assurance, Outsourcing, online accounting support, Company Registration, and CAC matters, please contact Sunmola David & CO (Chartered Accountants & Tax Practitioners) at Lagos, Ogun state Nigeria offices, www.sunmoladavid.com. You can also reach us via WhatsApp at +2348038460036.