The Federal Inland Revenue Service (FIRS) has introduced a new standardized tax Standard Operating Procedure (SOP), aimed at enhancing clarity, consistency, and transparency in Nigeria’s tax administration. This initiative forms part of a wider national tax reform agenda designed to streamline operations and improve public trust in the revenue system.

Covering more than 300 FIRS offices across the country, the SOP is intended to resolve long-standing inconsistencies in taxpayer interactions and compliance processes. In a statement on Tuesday, Mr. Collins Omokaro, Special Adviser on Communications and Advocacy to the FIRS Executive Chairman, emphasized the need for this reform, noting that varying practices across offices had created confusion and hindered voluntary compliance. He described the SOP as a roadmap toward a more efficient and citizen-focused tax experience.

The new SOP introduces a unified set of procedures for core tax activities such as registration, payment, auditing, and enforcement. By aligning these processes nationwide, FIRS aims to simplify tax compliance for individuals and businesses, making it easier to understand obligations and interact with the tax system.

Dr. Zacch Adedeji, the FIRS Executive Chairman, highlighted the SOP’s deeper significance beyond technical improvements. He characterized it as a reflection of the agency’s transformation into a transparent, service-driven institution committed to national progress and operational excellence.

The SOP also complements FIRS’s ongoing digital transformation, which combines human expertise with technology to deliver faster, more reliable services. The new guidelines are expected to improve internal efficiency, standardize staff training, and provide clear direction for employees across all branches.

According to Omokaro, the successful implementation of the SOP relies on every staff member embracing it fully: “From today, every FIRS staff member has a mandate—study it, apply it, embody it. That’s how we’ll earn the trust of Nigerians.”

By removing ambiguity and ensuring uniformity across locations, the SOP is expected to make tax administration more predictable and accessible. FIRS sees this reform as central to its evolution from an enforcement-heavy agency to a service-oriented authority, aimed at supporting economic growth and national development goals.

Experts have welcomed the move as timely and crucial for fostering voluntary compliance. The SOP rollout is also a key component of FIRS’s broader modernization drive, which includes digitized tax solutions, expanded taxpayer education, and enhanced institutional accountability.

As Nigeria looks to increase non-oil revenue, building a fair, efficient, and trusted tax system is essential. With the new SOP, FIRS aims to reduce administrative burdens while improving service delivery and boosting confidence in the country’s tax framework.

If effectively implemented and backed by consistent enforcement and engagement with stakeholders, this development could signal a major shift in Nigeria’s tax landscape. FIRS’s commitment to transparency, uniformity, and public service positions it as a vital driver of national development.

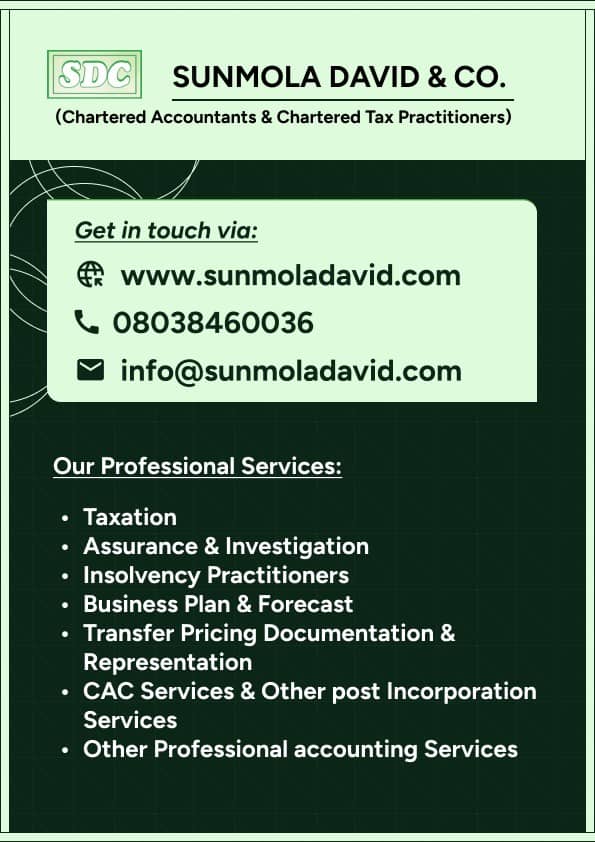

For professional advice on Accountancy, Transfer Pricing, Tax, Assurance, Outsourcing, online accounting support, Company Registration, and CAC matters, please contact Sunmola David & CO (Chartered Accountants & Tax Practitioners) at Lagos, Ogun state Nigeria offices, www.sunmoladavid.com. You can also reach us via WhatsApp at +2348038460036.