On August 1, 2025, the Federal Inland Revenue Service (FIRS) officially launched its electronic invoicing (e-invoicing) system, signaling a major advancement in Nigeria’s tax administration framework. This initiative aims to enhance transparency, reduce tax evasion, and align Nigeria’s tax processes with international best practices.

Key Highlights:

- Real-Time Transaction Monitoring: The e-invoicing platform enables FIRS to track business transactions in real time, strengthening compliance oversight.

- Large Taxpayers Targeted First: Companies with annual turnovers exceeding ₦5 billion are prioritized for early adoption.

- November 1, 2025 Integration Deadline: Large companies are required to complete system integration by this date, following a recently approved three-month extension.

- Adoption Momentum: Over 1,000 companies have already begun integration. MTN Nigeria was the first to submit live e-invoices, with Huawei Nigeria and IHS Nigeria expected to follow shortly.

- Strategic Objective: The platform is designed to streamline tax collection, curb revenue leakages, and support a data-driven compliance environment.

Our Take:

The rollout of the FIRS e-invoicing system marks a pivotal moment in Nigeria’s journey toward a modern, tech-enabled tax infrastructure. For large taxpayers, timely integration will be crucial not only for compliance but also for maintaining operational continuity and managing reputational risk. Businesses are encouraged to assess their readiness, upgrade systems where necessary, and engage early with tax advisors to ensure a smooth transition.

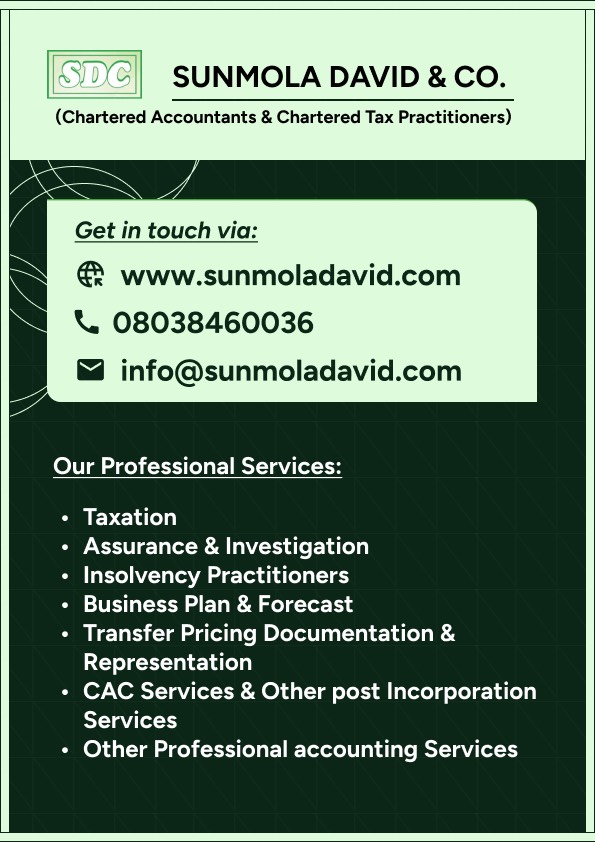

For professional advice on Accountancy, Transfer Pricing, Tax, Assurance, Outsourcing, online accounting support, Company Registration, and CAC matters, please contact Inner Konsult Ltd at www.innerkonsult.com at Lagos, Ogun state Nigeria offices. You can also reach us via WhatsApp at +2348038460036.