Nigeria’s equities market witnessed sustained bearish sentiment last week, with renewed sell pressure exacerbated by the reintroduction of Value Added Tax (VAT) on capital market transactions and the continued absence of strong fiscal incentives to attract long-term investments. This combination of regulatory burden and lack of investor stimulus led to a significant decline in market performance, driving the All-Share Index (ASI) below the psychological threshold of 27,000 basis points.

Speaking with Business a.m. on Friday, stockbrokers attributed the decline to a mismatch between market fundamentals and recent corporate performance. Despite a number of positive corporate actions—such as dividend declarations and robust earnings reports—the equities market remained subdued, unable to mount a meaningful recovery.

For the week ending Friday, the ASI of the Nigerian Exchange (NGX) depreciated by 1.40%, closing at 26,925.29 points, while the overall Market Capitalization fell to ₦13.121 trillion. This brought the year-to-date (YTD) performance to a wider loss of 14.33%.

With the exception of the NSE Premium Index, which recorded a modest gain of 0.64%, all other sectoral indices closed in the red. This negative trend persisted even though the trading week was shortened to three days due to public holidays declared by the Federal Government for Eid-El-Kabir celebrations on Monday, August 12, and Tuesday, August 13.

While traders had anticipated a potential rebound on Friday—fueled by Guaranty Trust Bank’s release of its audited financials showing a 4% increase in post-tax profit to ₦99 billion and an interim dividend payout of 30 kobo per share—market sentiment remained largely bearish. GTBank’s share price rose by 0.97% to close at ₦26, but this uptick was not enough to lift overall market performance.

In terms of trading activity, the Exchange recorded a total turnover of 726.607 million shares worth ₦10.459 billion across 12,915 deals. This was a decline from the previous week’s total of 1.081 billion shares valued at ₦12.014 billion exchanged in 16,246 deals.

The Financial Services sector once again dominated trading, accounting for 76.37% of the total volume and 62.14% of the value, with 554.910 million shares worth ₦6.499 billion traded across 8,376 deals. The Conglomerates sector followed, with 76.161 million shares worth ₦86.854 million, while the Consumer Goods sector recorded 29.783 million shares valued at ₦754.919 million.

Top traded equities for the week were Guaranty Trust Bank Plc, Zenith Bank Plc, and Transnational Corporation of Nigeria Plc. These three stocks accounted for a combined total of 303.101 million shares valued at ₦5.404 billion, representing 41.71% of the total volume and 51.67% of the market’s total value for the week.

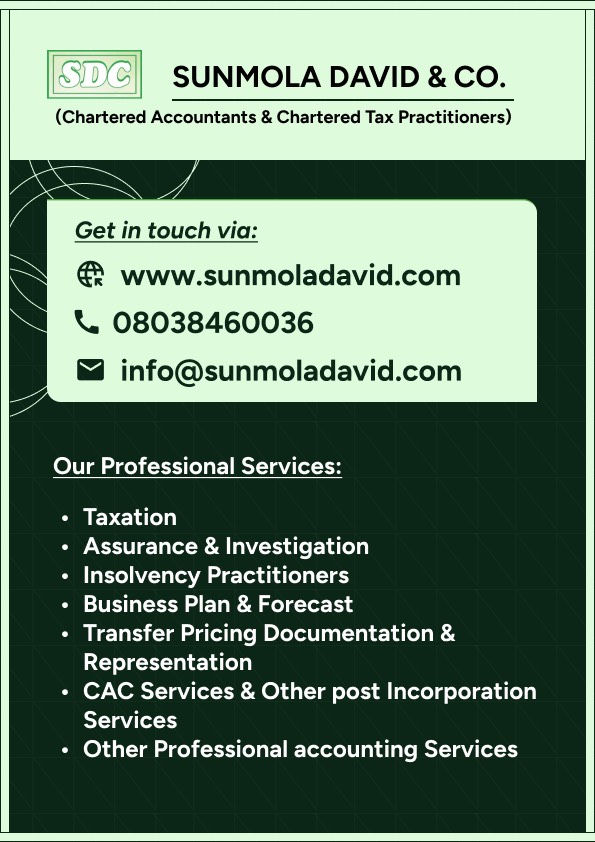

For professional advice on Accountancy, Transfer Pricing, Tax, Assurance, Outsourcing, online accounting support, Company Registration, and CAC matters, please contact Inner Konsult Ltd at www.innerkonsult.com at Lagos, Ogun state Nigeria offices. You can also reach us via WhatsApp at +2348038460036.