The Chairman of the Enugu State Internal Revenue Service (ESIRS), Emmanuel Nnamani, has revealed that an estimated 99% of the state’s informal sector fails to remit taxes—posing a significant challenge to revenue mobilization efforts.

Speaking at a media briefing in Enugu, Nnamani addressed circulating social media claims alleging the imposition of illegal taxes by the state. He dismissed these reports as “false and misleading,” reaffirming that all revenue collection activities are grounded in existing legal provisions.

“Enugu’s tax policies are fully compliant with the Personal Income Tax Act (as amended). We operate within the law and are committed to transparency,” Nnamani stated.

He explained that the ESIRS administers taxes through two main mechanisms:

- Pay-As-You-Earn (PAYE): For individuals in formal employment, with strong compliance levels.

- Direct Assessment: For self-employed individuals and informal sector participants, where compliance remains low.

Key Challenges in the Informal Sector

Nnamani highlighted that the core difficulty lies in bringing informal players—such as market traders and transport operators—into the formal tax net. He noted that interference by non-state actors has historically undermined official revenue collection.

To address this, the state has implemented a consolidated levy structure:

- ₦36,000 annual levy for market traders (covering sanitation, signage, business premises, and local government fees), payable between January and March.

- ₦30,000 annual fee for street-based vendors, with separate sanitation charges.

- Daily ticketing system for transport operators, including motorcycle riders (Okada), tricycle drivers (Keke), minibuses, tankers, and trucks.

Failure to remit taxes by March 31 attracts enforcement measures, including legal action where necessary.

Nnamani stressed that Enugu’s tax regime is not an outlier, but consistent with federal tax laws and frameworks adopted across other Nigerian states.

“We’re not trying to outdo any other state. Our goal is to uphold the law fairly and create an environment where our people and businesses can thrive,” he added.

Insight for Businesses:

As Enugu State strengthens enforcement and formalizes revenue collection in the informal sector, businesses—especially SMEs, vendors, and transport operators—should proactively regularize their tax status. Proper documentation and timely remittance can prevent enforcement actions and build long-term business credibility.

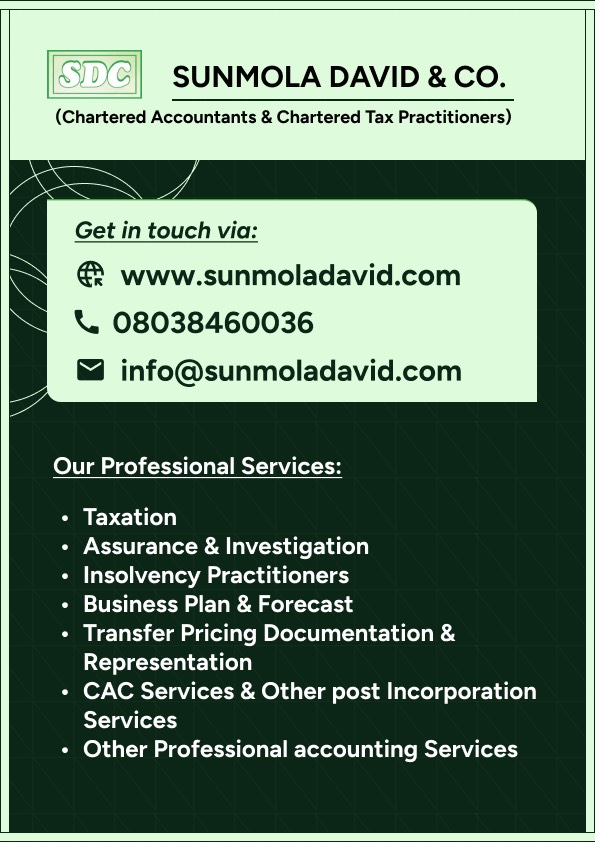

For professional advice on Accountancy, Transfer Pricing, Tax, Assurance, Outsourcing, online accounting support, Company Registration, and CAC matters, please contact Inner Konsult Ltd at www.innerkonsult.com at Lagos, Ogun state Nigeria offices. You can also reach us via WhatsApp at +2348038460036.